Many people are familiar with the old adage you should hold your age in bonds. For example, if you are 70 years old you should have 70% of your investments in bonds. The idea behind this axiom is that as you age your life expectancy becomes shorter and therefore has less ability to recover in market downturns. Fast forward to today and retirees are facing the more common probability of one spouse living until age 90 and beyond. In addition, interest rates are hovering around historic lows and have remained at these stubborn low levels for over a decade.

So, what is the right allocation for equities (stocks) and fixed income (bonds) for your investment portfolio? In order to determine this, one needs to know what rate of return your portfolio needs to earn to give you the best statistical chance for your retirement to end successfully. This nugget of information can be the key to determining your asset allocation.

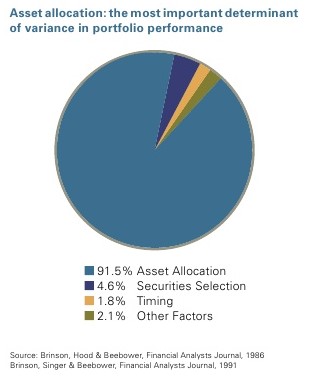

Research has shown us that investment rate of return is derived primarily by the allocation between stocks and bonds. Brinson, Hood, and Beebower published a study called “Determinants of Portfolio Performance”. The study revealed portfolio performance or rate of return is determined by various factors, but that asset allocation is the primary determinant.

Based on this knowledge, if you know what rate of return your portfolio needs to earn you can begin the process of selecting the allocation of stocks to bonds that will most likely achieve this goal. For example, the following is a sample of various asset allocations and their respective average annual return:

- Growth portfolio of 80% stocks and 20% bonds: Average annual return 9.7%*

- Balanced portfolio of 60% stocks and 40% bonds: Average annual return 9.0%*

- Income portfolio of 30% stocks and 70% bonds: Average annual return 7.7%*

*These rates of return1 are based on the research of Vanguard and considers the historical rates of return from 1926 to 2019.

At Rodgers & Associates we counsel our clients on the rate of return they need to achieve their retirement goals with the least risk possible. We also spend considerable time educating our clients on the drivers of their investment performance and on the perils of focusing on market timing and emotional investing. Research shows emotional investing may cost investors 17–23% of their assets over 10 years.2

Originally posted March 2016

- https://investor.vanguard.com/investing/how—to—invest/model—portfolio—allocation

- “Using a Behavioral Approach to Mitigate Panic and Improve Investor Outcomes” by Stephen Wendel, Ph.D. Journal of Financial Planning February 2018 page 48–56.