Among the items listed in the Executive Order on Strengthening Retirement Security in America issued by President Trump on August 31, 2018 was the request to update the life expectancy tables used to calculate required minimum distributions (RMDs) from retirement plans. The tables had not been updated since 2002, despite the fact that life expectancy has increased more than 8% for Americans who have reached age 65.

On November 7, 2019, nearly 15 months after the Executive Order was issued, the Internal Revenue Service (IRS) released proposed updated life expectancy and distribution period tables. The proposal must go through the formal approval process and will most likely take effect in 2021. The proposal includes updates to the factors used to calculate RMDs in each of three different life expectancy tables:

- Uniform Lifetime Table – Used by retirement account owners who have a spousal beneficiary who is less than 10 years younger.

- Joint Life and Last Survivor Expectancy Table – Used by retirement account owners who have a spousal beneficiary who is more than 10 years younger.

- Single Life Expectancy Table – For beneficiaries of inherited retirement accounts.

The new tables are not expected to have much impact for retirement account owners because the IRS reports that 80% of retirement account owners take more than their RMD annually. The 20% who are only taking the minimum will see some increased tax deferral benefits.

The switch to the new life expectancy table will be simple for retirement account owners taking lifetime RMDs. Beginning with RMDs calculated for the year 2021 and beyond, retirement account owners will take their factor from the life expectancy tables in the newly proposed regulations. The only confusion may be for those turning 72 in 2020, but who wait until 20201 to take their first distribution. These account owners could wait as late as April 1, 2021 to take their first RMD. Even though that RMD is taken in 2021, the RMD is for the year 2020. The factor would be calculated using the existing life expectancy tables, not the new life expectancy tables effective in 2021.

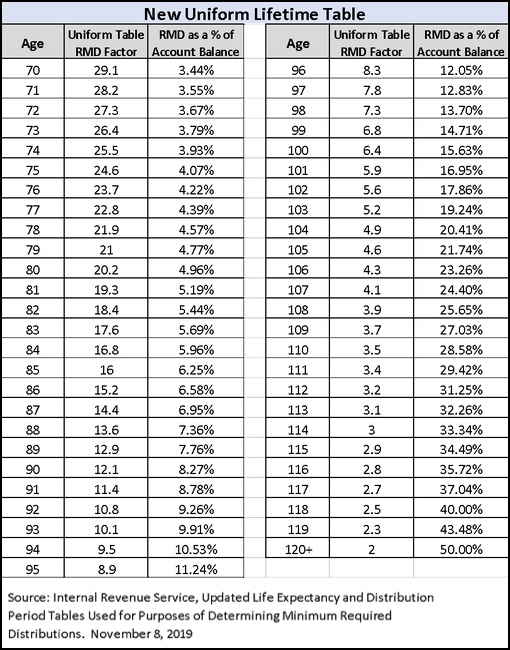

The Uniform Lifetime Table is the life expectancy table most familiar to retirement account owners. It is the table used to calculate the RMD by retirement account owners with a spousal beneficiary less than 10 years younger. The table begins at age 70, which was the youngest age for which an RMD can apply to one’s own retirement account. The table provides a decreasing life expectancy factor for each age until an owner reaches age 115.

The calculation for beneficiaries of inherited retirement accounts looking to maximize deferral will be even more confusing. These beneficiaries cannot simply use the new Single Lifetime Table going forward at their current age. They will need to retroactively determine what their life expectancy would have been for the first distribution under the new Single Lifetime Table. Then they will adjust forward to where that distribution schedule would be today by subtracting 1 year for each subsequent year since the year after the original account owner’s death. The Single Lifetime Table is never used by retirement account owners to calculate RMDs during their own lifetime. This table is only used by retirement account beneficiaries to calculate the RMDs from an inherited retirement account when the objective is to maximize the deferral period.

Those retirement account owners who take only the minimum RMD each year may be disappointed in the savings that result from the new tables. The updated tables provide modest relief on a year-over-year basis. A single individual reaching age 72 calculates their first RMD by dividing their year-end account balance by 25.6 under the current table. That equates to a first year RMD of approximately 3.91% of the prior-year-end balance. Under the new proposed Uniform Lifetime Table, the first year RMD is calculated by dividing the year-end balance by 27.3, equating the distribution to about 3.67% of the prior-year-end balance. That’s a difference of just $2,432 on a $1 million retirement account. In terms of tax savings, this works out to just $535 for a taxpayer in the 22% bracket.

The difference between the current RMD factors and the new table factors rises slightly as account owners enter their mid-80s. Tax savings would also be greater for those in higher tax brackets. However, the new tables do not create significant savings year-to-year. Even the cumulative effects of the changes do not have a significant impact on retirement account owners.

The big news is that the IRS has finally updated the decades old life expectancy tables used for calculating RMDs. The updates have been a long time coming. Unfortunately, for those retirement account owners who only withdraw the minimum, the decreases do not provide much of a benefit. However, at least it does help to defer some taxes, which ultimately preserves more of the owner’s tax-deferred dollars. The amount of the tax savings may be small, but some relief is still good news.

Rick’s Insights:

- The IRS proposed changes to the life expectancy tables used by retirement account owners to calculate their annual RMD.

- The IRS reports that 80% of retirement account owners take more than their RMD annually.

- The new life expectancy tables will result in the first RMD for an owner age 72 dropping from 3.91% to 3.67%.

1 The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2020 increased the required minimum distribution age from 70½ to 72 effective January 1, 2020.