Many retirees sign up for Medicare at age 65 as their primary form of medical insurance. However, if you retire before age 65 without coverage from a former employer, you may find yourself looking for coverage through the Health Insurance Marketplace. Depending on your income and household size, you may qualify for federal tax credits, a combination of credits and subsidies, or Medicaid. The surprising part is that some high-net-worth and high-income earners can qualify.

For example, a household of two 62-year-olds living in Lancaster County, PA with a total income of $68,960 may qualify for a $1,793/month tax credit, according to Pennie.com. The monthly premium amount for this couple could be about $475/month.

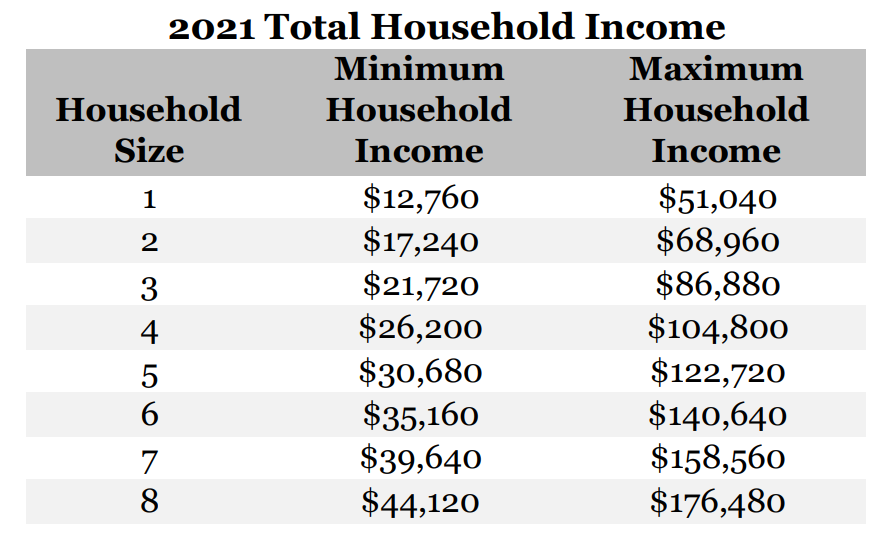

The key is finding ways to keep your income low. The same couple with an income of $68,961 or higher (400% of the federal poverty level in 2021) would not qualify for any savings!

The 2021 income thresholds for the Health Insurance Market Place subsidies are based on 2020 federal poverty levels. For those whose income is below the minimum income amount, coverage could be offered through Medicaid, instead.

If you are close to any of these income limits, be sure to work with your financial adviser in order to identify the best ways to reduce your income so that you qualify for a subsidy. Here are five ways you can lower your Modified Adjusted Gross Income (MAGI):

- Fund a Retirement Account: If you still have wages from a job and you qualify, contributing to a tax-deferred 401(k) will directly lower your taxable income. Or, if you have an individual retirement account, like a Traditional IRA, contributions to this account are typically deductible and can reduce your income.

- Defer Retirement Account Withdrawals: If you are taking distributions from your portfolio for living expenses, draw from your non-retirement accounts first. Investments that are sold here to generate cash for withdrawals are generally taxed on just the gains. On the other hand, IRA withdrawals typically count 100% as ordinary income. You might also make use of tax-free withdrawals from your Roth IRA (if eligible).

- Use Investment Losses: If you have a non-retirement account, it’s a good year-end habit to determine if you can take investment losses and net them with gains (see “What You Need to Know about Tax Loss Harvesting” for more information on this strategy).

- Wait to Take Social Security: A lot can go into this decision, but not drawing on Social Security means less income. Delaying Social Security income in order to preserve a health care insurance subsidy could impact your overall financial plan, so it is important to consult with your adviser on the impact of this decision.

- Keep Interest Income in Retirement Accounts: Investing more efficiently is dependent upon proper asset location. Hold interest-bearing investments (like bonds) in your retirement accounts, instead of non-retirement accounts. Then, hold equity investments (like stocks) that don’t pay dividends (and hopefully appreciate in value) in non-retirement accounts.

HealthCare.gov is a great place to start to understand your subsidy eligibility. If you are a Pennsylvania resident, you can visit the PA Pennie website to calculate your expected subsidy. It is important to understand what your total income will be in a given year, and then to work with an adviser to identify the best strategies to reduce your income where possible. Regularly reviewing tax projections and keeping up with changes in tax law can help you to anticipate what strategies will work best for reducing your income.

Originally published October 2014