Where do you want to live after you’ve reached financial independence? For many people, where they live is dictated by their career. That restraint ends once you have built your net worth and no longer need to work for a living. Do you want to live in the country, near the ocean, or in a busy metropolitan area with lots to do?

The question of where to live in retirement is a very personal decision, and the right answer will depend on many factors. Roughly 930,000 people age 60 and older moved across state lines in 2018. Financial implications are not necessarily the most important factor, but they’re definitely up there. Most reports published on the best places to retire give a heavy weighting to affordability. Other important considerations are access to healthcare, climate, and culture.

I was curious to see how Pennsylvania fared in the rankings of the best states for retirees. MoneyWise analyzed studies by Bankrate, WalletHub, and Kiplinger to create a list of the “best of the best” states for retirement. In 2019, Pennsylvania ranked number 14. MoneyWise cited our livable, four-season climate with warm summers, a pleasant fall, and a genuine winter. While Pennsylvania lacks a coastline, it offers easy access to beaches and lakes, mountains, and several bustling urban centers.

A more recent ranking by MoneyRates placed Pennsylvania in the thirteenth position overall.

Best States for Retirement 2021

| Overall Rank | State | Economy | Crime/Safety | Lifestyle | Healthcare |

|---|---|---|---|---|---|

| 13 | Pennsylvania | 42 | 13 | 10 | 15 |

RetirementLiving placed Pennsylvania at number eight in their top ten states to retire to, noting the many senior housing options to choose from and housing affordability.

| Percent of Pop. 65+ | 18.7% |

| Median Income | $61,744 |

| Percent in Poverty | 12.0% |

| Average Home Price | $180,200 |

| Top State Income Tax Rate | 3.07% |

| Cost of Assisted Living | $3,750/Month |

| Cost of Memory Care | $5,995/Month |

| Cost of Nursing Homes | $9.480/Month |

| Cost of In Home Care | $4,282/Month |

| Number of Hospitals | 176 |

| Number of Hospital Beds | 34,841 |

| Physicians Per 100,000 | 320.5 |

| Dentists Per 100,000 | 59.44 |

| Acres of Parkland | 295,000 |

| RL Rating | 7.52 |

Taxation is often cited as an important factor when considering where to live in retirement. The key aspects of taxes to consider are:

- State income tax: Seven states do not have a personal income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

- Taxation of retirement income: Four states—Hawaii, Illinois, Mississippi, and Pennsylvania—exempt all or most retirement income (such as Social Security benefits) from taxable income.

- Sales Tax: Adding a sales tax onto a purchase makes everything you buy a little more expensive. Pennsylvania has a 6% sales tax—but groceries, clothing, pharmaceutical drugs, and residential heating fuels are exempt.

- Property Tax: Property taxes can severely impact retirement living because the tax is not based on income or spending.

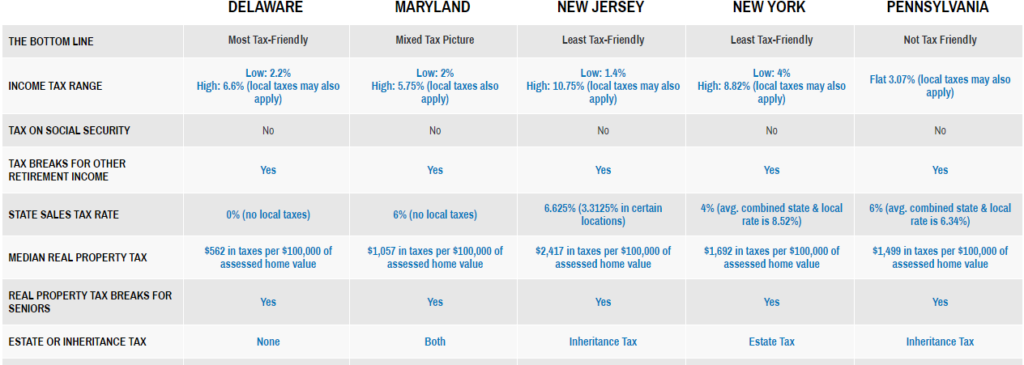

Kiplinger provides a helpful state-by-state guide to taxes for retirees. Their site allows you to compare states side-by-side. I used this resource to compare Pennsylvania with a few of its neighbors.

New Jersey is listed as the least tax friendly, but the state has taken steps to reduce retirees’ taxes. The state does not tax Social Security benefits or military pensions. The state recently eliminated its estate tax, but still imposes an inheritance tax. Taxpayers age 62 or older with income below $100,000 can exclude some or all of their pension, annuity, IRA, or other retirement plans. Unfortunately, New Jersey has the highest average real estate taxes in the country.

New York is another of the least tax-friendly states in the union. Real estate taxes are the seventh highest in the country, and average combined state and local sales taxes are tenth highest. Retirees can exclude Social Security and some pensions from the state income tax. However, anything over $20,000 from a private retirement plan or out-of-state government pension is taxed.

Maryland doesn’t tax Social Security benefits and allows filers age 65 or older an exclusion of up to $33,100 (2020 amount) on distributions from 401(k), 403(b), and 457 plans, along with income from public and private pensions. However, income above the exclusions will be heavily taxed. The state income tax has a top rate of 5.75%, and Maryland’s counties and cities may levy additional income taxes ranging from 1.75% to 3.20% of taxable income.

Delaware is the most tax-friendly state of the group. There is no sales tax, property taxes are low, and they don’t have a death tax. Taxpayers over age 60 can exclude $12,500 of pension and other retirement income from state income taxes. Above this exclusion, the state income tax is applied in a range from 2.2% on taxable income from $2,001 to $5,000, up to 6.6% on taxable income above $60,000. There is a property tax credit of up to $400 for homeowners age 65 and older once they have lived in the state for ten consecutive years.

Many clients have told me the most important factor for them is living close to the people they love and care about. Before you decide to move, consider what’s really important to you: costs of living, healthcare and tax laws are important, but they aren’t the only things you’ll need to consider.

Insights:

- Surveys report that more than a third of seniors move to another state after retirement.

- Affordability, access to healthcare, climate, and culture are just some of the important factors to consider before moving to another state.

- Taxes—like income tax, sales tax, and property tax—can have a huge impact on one state’s affordability over another.

Originally posted September 2019