House Republicans boasted their 2017 tax reform would simplify taxes to the point that taxpayers would be able to file a return on a postcard. The Tax Cuts and Jobs Act (TCJA) of 2017 did simplify tax filing in some areas, notably itemized deductions. However, it also added a level of complexity in other areas: the new exclusion of business income will require filing an additional form. It was the Bipartisan Budget Act of 2018 (BBA) that provided for simplified tax filing for some.

BBA is the two-year budget agreement signed by President Donald Trump on February 9, 2018. Section 41106 of the BBA creates a new simple tax form for seniors known as the 1040-SR. BBA requires that the Internal Revenue Service make the 1040-SR available for taxable years beginning after the date of enactment. It will apply to years beginning after that. Taxpayers age 65 or older will have the option to use this new form when they file their 2019 income taxes.

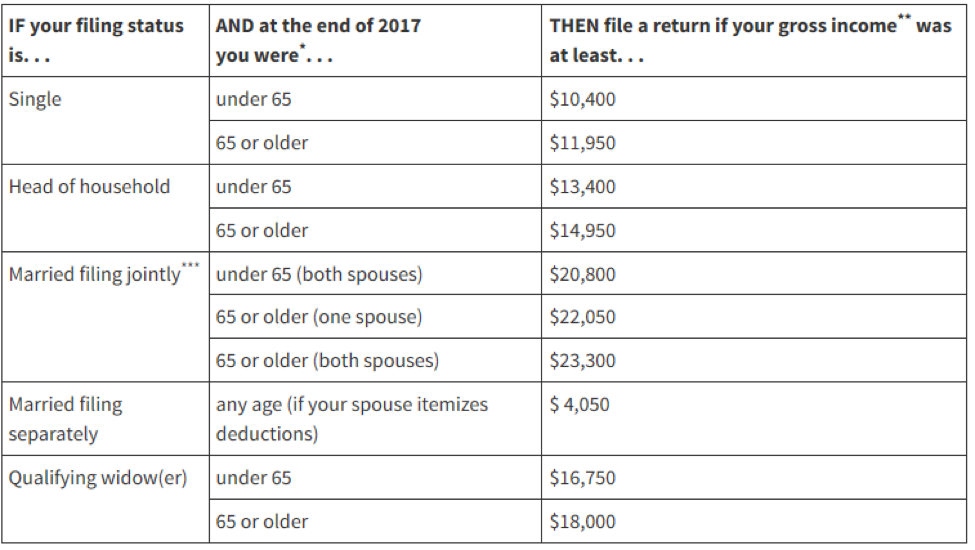

The IRS publishes “Tax Guide for Seniors” (Publication 554), which provides a general overview of selected topics that are of interest to older taxpayers. Taxpayers do not need to file a tax return if you don’t meet the filing requirements and aren’t due a refund. The table below shows the income thresholds:

Source: IRA publication 554

The idea of a simpler return for seniors is not a last-minute provision hastily added to the budget. The concept has been around for five years when a few senators first proposed the Seniors Tax Simplification Act. The AARP and the National Taxpayers Union endorsed the legislation, but it never got passed in the Senate. The provision finally made it into BBA 2018. Legislators believed this form was needed because it filled an important gap for older citizens who are not permitted to use the standard Form 1040-EZ.

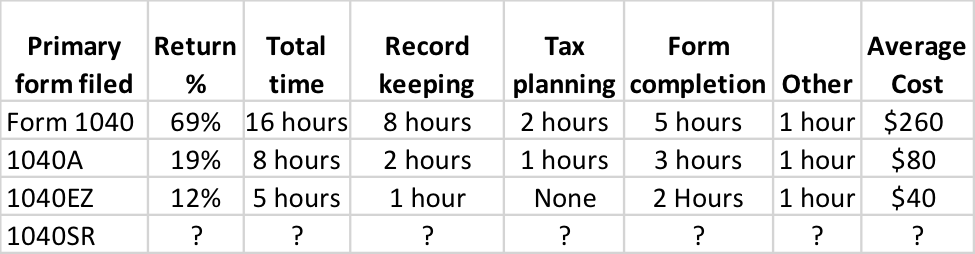

How long it takes to prepare tax returns

Tax returns have gotten more complex and harder to prepare over the last few years. The IRS said that it took 13 ½ hours for Form 1040 filers to prepare their returns in 2004. Today, the IRS says Form 1040 filers need 16 hours to prepare their return. The IRS reported the average taxpayer spends 13 hours preparing their tax return. Taxpayers that file the 1040 short forms—Form 1040A or 1040-EZ—spend the least time. Unfortunately, only 12% of taxpayers file the one-page Form 1040-EZ, which is a mere 14 lines long. An important requirement for using Form 1040-EZ is the taxpayer must be under age 65. The following chart prepared by the IRS shows how long it takes taxpayers to prepare various types of tax returns.

Source: IRS, 2014 Form 1040 Instructions, “Estimates of Taxpayer Burden.”

1040-SR versus 1040-EZ

The new Form 1040-SR will be similar to Form 1040-EZ. One difference is that Form 1040-EZ only allows the taxpayer to report income from wages, salaries and tips. Form 1040-SR will allow income from certain other sources such as investment income, Social Security, and distributions from qualified retirement plans, annuities or similar deferred-payment arrangements.

The biggest difference is the age requirement. Taxpayers must be 65 or older by December 31, 2019, or by the end of the tax year they begin using the form. Taxpayers under age 65 who otherwise meet income and filing requirements should continue to use Form 1040-EZ. Retirement is not a requirement. Taxpayers working past age 65 will qualify to file 1040-SR.

Form 1040-SR does not have an income limit like 1040-EZ, which limits total income to $100,000 or less. However, taxpayers are required to take the standard deduction which was increased to $12,000 for single filers and $24,000 for joint filers by TCJA. Taxpayers 65 or over are entitled to an additional $1,300 standard deduction. Individuals using Form 1040-SR would take a standard deduction of $13,300 for tax year 2019. Married taxpayers filing a joint return if one is 65 or over would take a deduction of $25,300, and $26,600 if both are over 65.

A taxpayer who is retired but under the age of 65 whose income sources include Social Security, pensions and investment income, does not qualify to use 1040-SR or 1040-EZ. Their best option is Form 1040A if they want to avoid using the full Form 1040. The new legislation isn’t perfect. However, the Form 1040-SR is a step in the right direction when it comes to the simplification of tax-filing requirements.

To receive valuable updates regarding strategies to preserve your wealth you can subscribe to our twice monthly newsletter.

Rick’s Tips:

- Taxpayers age 65 or older will have the option to use Form 1040-SR beginning in tax year 2019.

- The IRS reports a taxpayer using the shorter forms 1040A and 1040-EZ take about half the time filing returns as someone using the long form.

- Taxpayers are no longer permitted to use Form 1040-EZ once they reach age 65.