Social Security maximization is a hot topic among retirement planners and the financial press. Maximization strategies focus on the age to draw benefits and the sequence of who draws first when dealing with married couples. The objective is to get the most dollars from Social Security during your retirement.

The age of death is an essential variable. No one knows, of course, when they will die. From a Social Security perspective, the critical age is 82. This is the age you must reach to realize the benefit of waiting to draw Social Security. A single person who anticipates not living to age 82 due to identified illness or family history would be a good candidate for earlier filing.

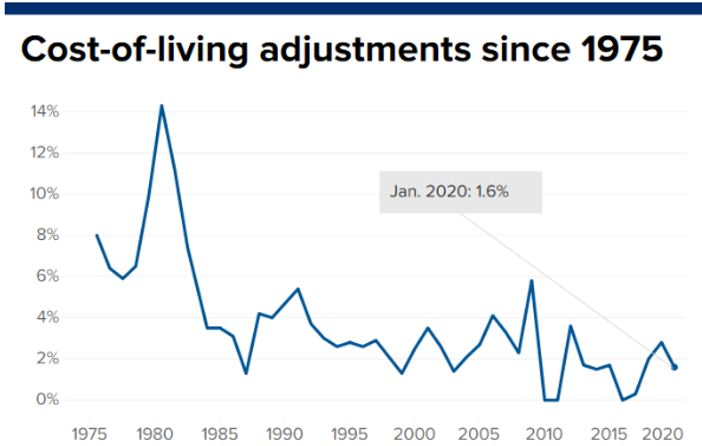

Consider a worker earning the maximum-taxable earnings ($137,700 in 2020) who would be eligible to collect $2,265 per month in Social Security benefits at age 62 if they started drawing in 2020. Waiting another eight years to draw at age 70 would increase the monthly benefit to $3,790 – an increase of 67%. This doesn’t consider the automatic cost-of-living adjustments (COLA) that will be applied to the benefits. COLAs have averaged 2.15% annually since 2000. Including COLAs into the calculation raises the benefit to $4,493 per month at age 70!

The higher benefit at age 70 means nothing if the worker dies before age 82. However, Social Security actuarial tables show that the average life expectancy for a male aged 70 is 14.4 years, and for a female, it is 16.5 years. A healthy 70-year-old has a good chance of maximizing their Social Security by delaying the start of their benefits.

Life expectancy is not the only criteria to consider when making this decision. If you retire at age 62, you’ll need income from somewhere. Drawing Social Security early allows you to preserve your savings longer. You can keep your savings invested and growing longer by using your Social Security benefits to meet your living expenses.

The other important consideration for the more affluent retiree is the financial challenges facing the future of Social Security. While it is unlikely that changes to benefits will be made to those who are already retired, it could happen—especially to those who have done an excellent job preparing for retirement and have adequate retirement income from other sources. A retiree may delay drawing benefits only to find out the amount they were expecting to receive has been changed. In the meantime, the retiree had been using their savings for living expenses.

In 1983, legislation was designed to shore up the Social Security system by raising taxes, boosting inflows, and setting the stage to grow the trust fund dramatically. Today, that trust fund has over $2.9 trillion in assets. The 2019 Trustees Report projects that benefit payments will exceed trust income beginning in 2021. The Social Security system has a financial challenge going forward. The trust fund is projected to be depleted by the mid-2030s. At that time, future tax receipts are expected to pay out about 79% of promised benefits.

There have been numerous Social Security fixes proposed, including raising the benefit eligibility age, changing the benefits formula, and raising the cap on income subject to Social Security tax. These “fixes” could be minor if enacted quickly. The more prolonged action is delayed, the more draconian the changes will need to be.

Unfortunately, our politicians seem unwilling to make changes of any kind. President Obama’s 2014 budget proposal called for a reduction in future Social Security outlays by changing the annual cost-of-living increase to a chained Consumer Price Index (CPI) method. The plan went nowhere.

Anyone who has done an excellent job saving for their retirement should consider the chance that Social Security benefits will be means-tested in the future. This is an essential factor to consider when planning the start of Social Security benefits. Means testing of Social Security benefits already takes place in the form of taxation. It would not be a big stretch to propose only providing monthly benefits to retirees who have less than a certain amount of non-Social Security annual income.

Medicare premiums are already means-tested. A single senior whose income is over $87,000 will see a 40% increase in their Medicare premium. Another 42% premium increase applies when income exceeds $109,000. The top income level is $500,000 when Medicare premiums are 3½ times the basic premium. It would be reasonably easy for politicians to apply a similar formula to Social Security benefits. Wealthy seniors would give up a portion of benefits at each of the income thresholds already established for Medicare premiums.

Means testing could also come in the form of an asset-based cap instead of income-based cap. An excise tax could be levied on retirement accounts. There was a 15% excise tax imposed on excess distributions from qualified retirement plans, tax-sheltered annuities, and IRAs in the mid-1990s. A similar tax could be reinstated with the proceeds dedicated to the Social Security trust fund.

The decision to draw Social Security benefits is an important one for all retirees. Make sure you consider all the critical issues before making this decision. A qualified retirement planner can help you evaluate all your options.

Rick’s Insights:

- Life expectancy is one of the most critical variables to consider when deciding when to start Social Security benefits.

- Social Security benefits can be subject to income taxes based on your other sources of income.

- Means testing should be considered by wealthier retirees when deciding when to start drawing Social Security benefits.