Since the passage of the SECURE Act in 2019, the distribution rules regarding inherited IRAs have become highly complicated—with rules that vary widely across situations. How can you know which rules apply to you? And what’s the best strategy to avoid some of the adverse consequences of these new distribution rules?

In this article, we’ll examine three key questions to answer when inheriting an IRA. Those answers will give you the necessary information to make the most of your inheritance and avoid unnecessary pitfalls.

1. What kind of beneficiary are you?

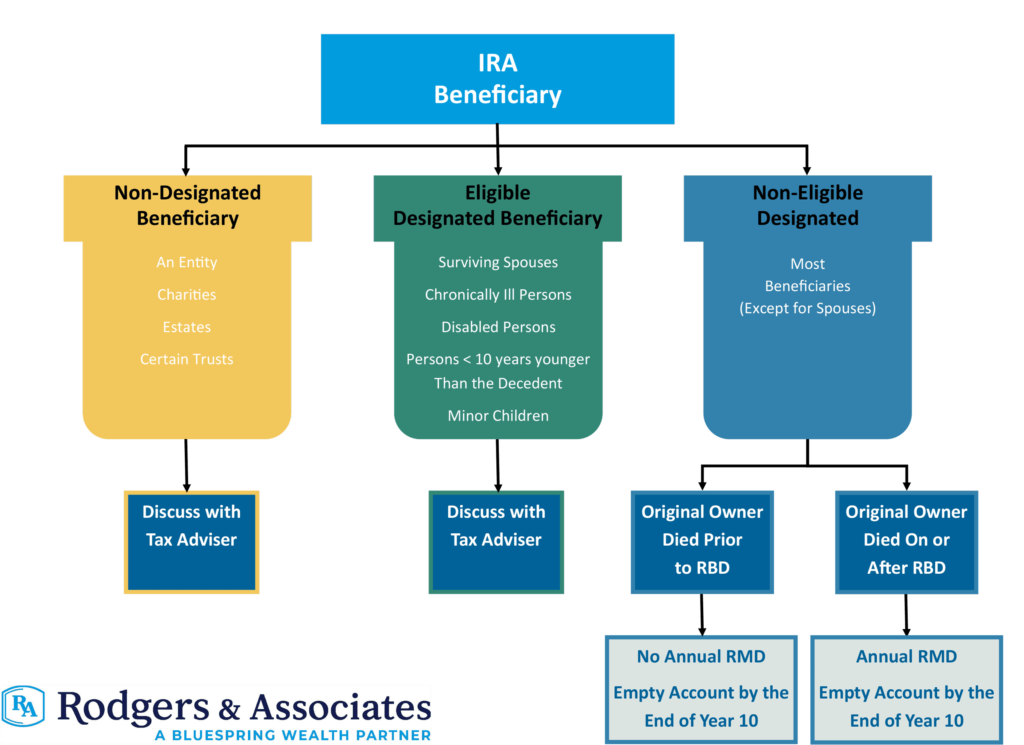

The SECURE Act created three different types of beneficiaries.

- Non-designated beneficiaries include charities, estates, and certain trusts. If it’s not a person, it’s a non-designated beneficiary.

- Eligible designated beneficiaries include surviving spouses, disabled or chronically ill people, minor children, and people less than 10 years younger than the original owner.

- Non-eligible designated beneficiaries are any beneficiaries that do not fit the criteria above. Most beneficiaries, except for spouses, fall into this category.

It’s critical to correctly determine which kind of beneficiary you are, because it will determine which distribution rules apply to you.

2. Was the original owner past their required beginning date?

In other words, was the original owner required to take an RMD for the year of death? This is important for two reasons.

First, if the original owner was required to take an RMD and passed away before taking it, the beneficiaries must take that RMD before the end of that year. Technically, this is the final RMD required from the original owner. If there are multiple beneficiaries, this RMD is usually split between them, but it needn’t be. The only requirement is that the remaining RMD for the original owner be distributed before the end of the year.

Second, the owner’s required beginning date (RBD) will also determine which rules apply for the inherited IRA beneficiaries. Generally, if the owner is past their RBD, the beneficiaries must continue to take RMDs annually based on their remaining life expectancy. The first RMD from the inherited IRA would need to be taken by the end of the first year after the original owner’s death.

3. What are the rules for non-eligible designated beneficiaries?

Most of the confusion regarding inherited IRAs concerns the rules for non-eligible designated beneficiaries. This is a very common scenario, as most children who inherit IRAs from their deceased parents find themselves in this category. There are two rules to keep in mind:

If the original owner was past their required beginning date, an RMD must be taken from the inherited IRA based on the beneficiary’s life expectancy starting the year after death. When the SECURE Act was passed in 2019, there was some confusion over this requirement, and required distributions were waived through 2024. However, the IRS has issued final guidance—and starting in 2025, annual RMDs will be required from beneficiaries.

The inherited IRA must be emptied entirely within 10 years. The clock starts the year after the original owner’s death. Unlike the annual RMD above, this rule applies regardless of whether the original owner was past their RBD. Here are two examples to illustrate the point.

- Rob passes away in 2024 after his RBD and leaves his IRA to his son, Peter. Peter will need to take the RMD for the year of Rob’s death if Rob did not take it. Peter will also need to take annual RMDs based on his life expectancy starting in 2025. He must completely empty the IRA by the end of year 10 (2034).

- Margaret passes away in 2024 before her RBD and leaves her IRA to her daughter, Amy. Amy does not have to take any RMDs as her mother was not past her RBD. However, she must liquidate the account by the end of year 10 (2034).

Now that you know the rules, what are tax-efficient strategies for children who inherit their parents’ IRAs?

- Maximize other tax-deferred accounts and use inherited IRA funds for cash flow.

Whether an RMD is required or not, maxing out your 401(K), traditional IRA, and/or health savings account may make sense. You can then compensate by taking distributions from the beneficiary IRA. This will allow you to effectively shift assets out of the account with the 10-year clock and into accounts that can be distributed throughout your retirement. - Shift high-growth assets from the inherited IRA into other more favorable accounts.

If you know that the beneficiary IRA will need to be emptied in 10 years, it may be a good idea to holistically rebalance your portfolio and shift your high-growth assets (like equities) into other accounts with more favorable tax treatment. This will keep your overall asset allocation the same while avoiding a large tax bill either during or after the 10-year period due to the growth of the assets in the inherited IRA. - Make qualified charitable distributions.

If you are over age 70½ (or know that you will be before the 10-year period is up), you can consider making qualified charitable distributions from the inherited IRA. QCDs satisfy RMD requirements and are not counted as taxable income on your tax return. - Take advantage of low-income years.

If your income is variable, you should take distributions during low-income years when you find yourself in a lower tax bracket. Likewise, if you are planning to retire within the 10-year payout period, it may make sense for you to defer most of the distributions from the beneficiary IRA until you stop working. This will ensure that you take the funds out of the account at the lowest tax bracket possible.

Insights:

- There are three types of beneficiaries of inherited IRAs. Most non-spouse beneficiaries are considered non-eligible designated beneficiaries.

- If the original owner died after their required beginning date, annual RMDs must be taken by non-eligible designated beneficiaries.

- Non-eligible designated beneficiaries must liquidate the inherited IRA account by the end of the 10-year period that starts the year after death.