Patience and temperament are key personality traits of a good investor. Investing is a long-term strategy, and the ability to remain calm and not react with emotion is imperative. Investing requires the belief that the future will be better than the present. Fortunately, history is on the side of the optimistic investor.

The market advances with technology

Progress can be measured in many ways. The 1940 Packard was the first car to offer factory-installed air conditioning. Today, electric cars can drive themselves. Twenty years ago, we could not be on the phone and use the internet at the same time. Now we can talk on the phone while using the same device to order our groceries for delivery. We can attribute increased life expectancies to medical advancements over the years. Technological advances have made our life more efficient while saving us time. The world today is more advanced than any other time in history.

A simple example is to compare your life to that of your children, parents, and grandparents. From one generation to the next, the quality of life has improved by most measures. I recall one instance when my daughter and I were going through a bin that I had from high school. I heard her ask, “Mom, what is this?” When I looked to see what she was inquiring about, she was holding a photographic negative. This was completely foreign to her because the only type of photography she has ever known is digital.

Slumps never last

Of course, progress can lead to new problems. However, creating solutions to these new problems is the way of the world—and is often done through for-profit businesses that trade on public exchanges. Investors can then share in the profits of these companies without being a part of the day-to-day operations. Being an investor can be nerve wracking, as we saw earlier this year during the downturn that resulted from the pandemic. However, a well-diversified portfolio of stock market indices has a history of recovering after each downturn.

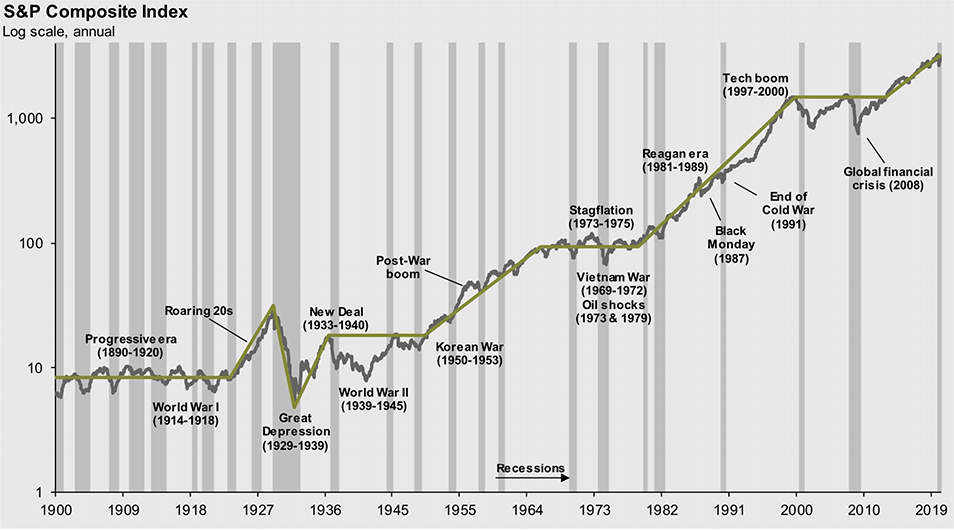

The chart below depicts the stock market’s performance through the years. When looking at the broader picture, we can see how the market has grown over time. As an investor, you must be able to look optimistically beyond the short-term. Otherwise, pessimism can encourage poor, emotional decision-making that will directly correlate with your long-term rate of return.

Data shown in log scale to best illustrate long-term index patterns. Past performance is not indicative of future returns. Chart is for illustrative purposes only.

Guide to the Markets — U.S. Data are as of June 30, 2020

Originally published in April, 2016