“Don’t save what is left after spending; spend what is left after saving.”– Warren Buffet

One of the most important financial lessons to teach our children and grandchildren is the importance of saving and investing. We all start out life by working for money. The goal should be to put some of the money we work for aside regularly and invest it. Eventually, we could have enough money working for us that we no longer need to work for money. We will have achieved financial independence!

Parents and grandparents often ask me how they can help their children achieve financial independence without spoiling them. They are in a financial position to make gifts but are not sure if financial gifts would help or harm them. Here are two smart ways to gift that can offer some immediate benefits and help them along the way to financial independence.

Make a Roth IRA Contribution

Put your children and/or grandchildren on the path to a secure retirement by making a Roth IRA contribution for them as soon as they have earned income. Any child or grandchild that receives a W‑2 can make a Roth contribution based on this income regardless of their age. Funding a Roth IRA, or any retirement account for that matter, is usually not a priority for a teenager’s part-time income. This is an opportunity for parents or grandparents to start saving for the child while they are young. Small amounts invested can go a long way when you are young and have years for the money to compound.

The maximum contribution in 2019 is $6,000 or 100% of earned income, whichever is less. You could make a Roth contribution based on the earnings they have from a summer job. Total up their W‑2 statements at tax time and make the Roth contribution for the total amount.

Let’s assume you make a $6,000 contribution to a Roth for your child every year starting at age 16 until they are 25. If no other contributions are made and the account grows at an average of 7%, their Roth IRA would grow to $1,800,000 by the time they are age 60. Not bad for a $60,000 investment!

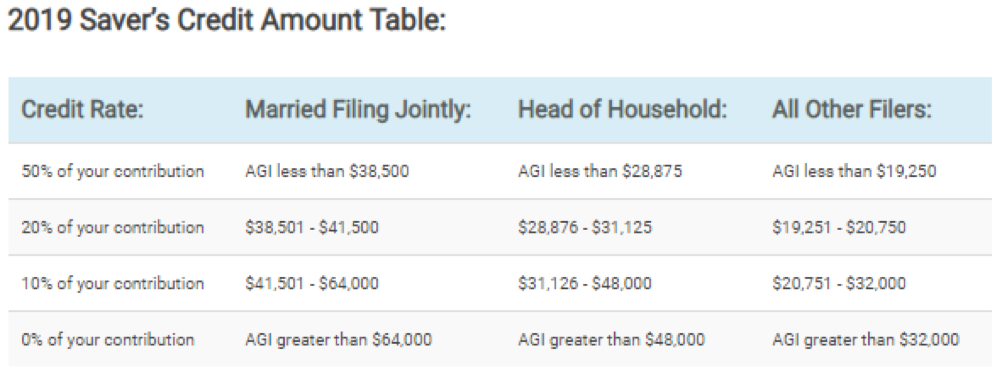

The earnings will be tax free when withdrawn, providing all other requirements are met. Adult children living on their own may also qualify for The Retirement Savings Contribution Credit, known as the Saver’s Credit based on your gift to their Roth IRA. This credit may allow them to get a tax credit for up to half of what you contribute to their Roth IRA. Up to $2,000 of your contribution is eligible for the credit. They cannot be claimed as a dependent on anyone else’s tax return and their income must be within specific guidelines to qualify.

Source: IRS.gov

Fund a Health Savings Accounts (HSA)

An HSA can be defined as a type of savings account you can fund on a pre-tax basis and use to pay for qualified medical expenses. These accounts are only available to people who are covered under a High Deductible Health Plan (HDHP) and do have limits on the amount of money you can contribute to them.

2019 HSA Contribution Limits:

- Individuals: $3,500

- Families: $7,000

- $1,000 catch-up if age 55 or older

HSAs were designed for saving money to cover health expenses that aren’t covered by insurance. Many people use their HSA to cover copayments, deductibles, and other non-covered expenses. HSAs must be connected to an HDHP where the HSA helps patients cover the large deductible. The HDHP kicks in after the deductible is met to cover the more expensive health services like hospital stays.

Advantages of Gifting an HSA

An HSA has some important advantages over other ways of saving for healthcare costs:

- Contributions are pre-tax: Contributions to an HSA are made pre-tax like a traditional IRA or a 401(k)-retirement plan.

- Deposits can carry from year-to-year: HSA contributions roll over from one year to the next if they aren’t withdrawn for healthcare expenses.

- Investment choices: Balances in an HSA can be invested in mutual funds and other financial instruments much like a 401(k). Investment options can help the account grow more quickly than a traditional savings account.

- Tax-free withdrawals:Funds withdrawn from an HSA for approved medical expenses are not taxable. The pre-tax contributions and any earnings while the money was inside the account are tax-free when the funds are used for appropriate medical expenses. This makes an HSA an extremely efficient way to save money for health expenses when you have a HDHP.

A good way to help a child or grandchild who is working for an employer that offers an HSA plan is to fully fund it each year for them. The contribution will help them save taxes each year on the amount invested. More importantly the growth in the account can be used to cover future medical expenses tax-free.

For more ways to help your children or grandchildren reach financial independence, here are some other gifting strategies to consider.

Rick’s Tips:

- Any child or grandchild that receives a W‑2 can make a Roth contribution based on this income regardless of their age.

- Contributions to an HSA are made pre-tax like a traditional IRA or a 401(k)-retirement plan.

- Funds withdrawn from an HSA for approved medical expenses are tax-free.