What is the best filing status to choose for your tax return? There are five filing statuses and the one a taxpayer chooses will affect their tax liability. Filing status is especially important because it determines, in part, the tax rate applied to taxable income, the amount of the standard deduction, and the types of deductions and credits available. Choosing the right filing status, is the first step towards minimizing income taxes. Research shows most couples file joint returns, as filing separately could mean a bigger tax bill. However, filing a separate return is often recommended if they distrust their spouse’s finances.

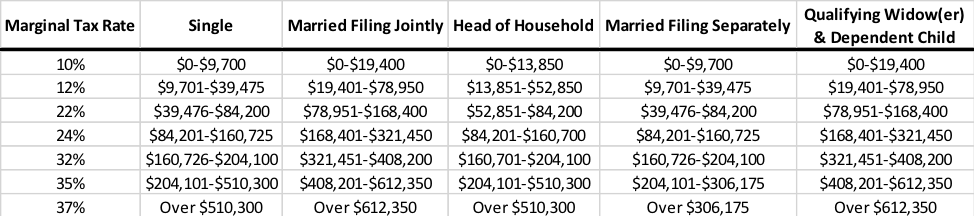

The five filing statuses – 1) single, 2) married filing jointly, 3) married filing separately, 4) head of household, and 5) qualifying widow(er) with dependent child. There are seven income tax brackets for 2019 and the amount of tax will depend on a taxpayer’s filing status and amount of taxable income.

Source: Tax Foundation

Single

A taxpayer may file as “single” if he/she is unmarried, divorced, legally separated, or widowed as of the last day of the calendar year (December 31st). This one’s pretty straightforward. And, depending on your circumstances, it may be your only option. The IRS generally requires taxpayers to file as “single” if they do not meet the criteria for the other filing statuses.

Filing single can possibly lower taxes for two taxpayers who make high incomes. At the highest tax brackets, the income levels that determine the tax brackets for married people filing jointly are less than double the income levels for single filers. It is a circumstance commonly referred to as “the marriage penalty.” Married couples with high incomes can owe more taxes than two single people with the same total income.

Married Filing Jointly

For the majority of married couples, this status will most likely result in tax savings. You may file jointly if, on the last day of the tax year, you are:

- Married and living together

- Married and living apart, but not legally separated under a divorce decree or separate maintenance agreement, or

- Separated under an interlocutory (i.e., not final) decree of divorce

- Also, you are considered married for the entire tax year for filing status purposes if your spouse died during the tax year.

When filing jointly, a taxpayer and their spouse combine income, deductions, and credits. There are many credits available to joint filers that married taxpayers filing separately cannot take. These include the child and dependent care credit, the adoption expense credit, the American Opportunity credit (the Hope credit), and the Lifetime Learning credit.

Head of Household

This status could offer certain income tax advantages (bigger deductions and more exemptions) to taxpayers who qualify. The tax rate thresholds are higher than for single filers and married filing separately filers. The standard deduction is also larger. Here are the requirements a taxpayer must meet:

- The taxpayer should be unmarried at the end of the year (unless you live apart from your spouse and meet certain tests)

- Must maintain a household for taxpayer’s child, dependent parent, or other qualifying dependent relative

- a child under 19, or under 24 if a student

- dependent parent doesn’t have to live with the taxpayer if they can prove they provided at least half their support

- See IRS Publication 17 for specifics

- The household generally must also be the main home of a qualifying relative for more than half of the year

- Taxpayer must provide more than half the cost of maintaining the household

- Taxpayer must be a U.S. citizen or resident alien for the entire tax year

Married Filing Separately

This filing status is not always the most advantageous. However, when a spouse owes certain debts (including defaulted student loans and unpaid child support), the IRS may divert any refund from a joint tax return to the appropriate agency. To get a share of the refund, the taxpayer would have to file an injured spouse claim. This hassle can be avoided by filing a separate return.

The taxpayer does not have to be separated to choose married filing separately. Both spouses report only their income and claim their deductions and credits. Filing separately may be wise if each taxpayer wants only to be responsible for their own tax. With a joint return, by comparison, each spouse is jointly and individually liable for the full amount of the tax due.

Filing separately could be a good tax move if one spouse has significant medical expenses. The ability to take a deduction for medical expenses is tied in to the level of adjusted gross income (AGI). Medical expenses are generally deductible only if they exceed 10 percent of AGI in 2019 (7.5% of AGI in 2018.) By filing separately, the AGI for each spouse is reduced.

Married taxpayers filing separately won’t qualify for certain credits (such as the child and dependent care tax credit) and can’t take certain deductions (such as qualified education loan interest).

Qualifying Widow(er) with Dependent Child

This filing status offers many of the advantages of a joint return. Taxpayers may select this status if their spouse died recently. The status allows joint tax rates and offers the highest possible standard deduction. To qualify, you must satisfy all of the following conditions:

- Spouse died either last tax year or the tax year before that

- Taxpayer qualified to file a joint return with their spouse for the year he or she died

- Did not remarry before the end of the tax year

- Taxpayer has a qualifying dependent child

- Foster children are not included in the definition, nor are any other types of dependents.

- Taxpayer provided over half the cost of keeping up a home for the qualifying child

- Child must reside in the same household with the taxpayer for the entire year except for “temporary absences”.

The surviving spouse can file a joint return with the deceased spouse for 2019 if the spouse died in 2019. They can then file using the qualifying widow/widower status for tax years 2020 and 2021 if the taxpayer qualifies. They would need to choose another filing status for tax year 2021 and going forward, such as single or head of household, depending on their circumstances.

Choosing the correct filing status is important and not always easy. You might want to speak with a tax professional or financial adviser for guidance. You can also consult IRS Publication 17 for more information.

Rick’s Tips:

- A “marriage penalty” can occur when spouses both have high incomes and file jointly as a married couple.

- Head of Household filing status could offer bigger deductions and more exemptions to taxpayers who qualify.

- The IRS offers a special filing status to ease some of the financial burden experienced by a qualifying widow or widower.