We always advise our clients to work with an estate planning attorney to draft and execute four estate planning documents:

- A Last Will and Testament (Will)

- A Durable Financial Power of Attorney (DPOA)

- A Durable Health Care Power of Attorney (HCPOA)

- Medical Directive

Read on to learn more about each type of document and why each is important in helping to make sure your estate plan is in order.

1. A Last Will and Testament (Will)

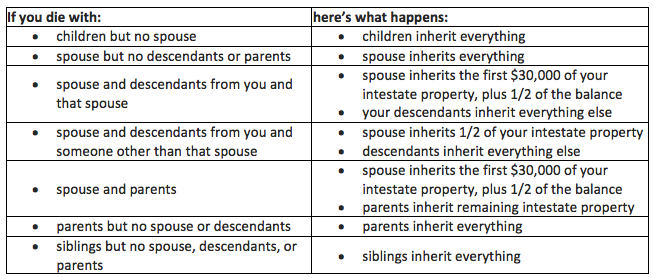

Where there’s a will, there’s a way. Without a will, your assets, at least the ones not held jointly or in a retirement account or insurance account with a beneficiary, will go by the state’s way, not your way. When you die without a will, you are said to be intestate. The state will appoint an administrator or personal representative to distribute your assets according to your state’s intestacy laws. This can take some time.

In Pennsylvania, intestate succession works like this:

Source: NOLO

So yes, you need a will.

2. A Durable Financial Power of Attorney (DPOA)

You also need a durable financial power of attorney. This document gives a trusted individual, called your agent, the legal authority to act on your behalf in financial matters. Typically, a power of attorney would act on your behalf when you become incapacitated, but this document gives your agent the authority to act at any time. You can designate specific powers for the agent. It is generally a long list. A POA document could allow your agent to:

- Pay your bills, taxes, and medical expenses

- Manage your real estate assets and financial accounts

- Invest on your behalf

- Collect retirement benefits for you

- Transfer and sell your assets

- Buy insurance

- Operate your small business

- Hire legal-council

- Change or name beneficiary designations if specifically stated in POA

- Gift assets to others, including charities, if specifically stated in POA

And once you execute it and the agent acknowledges it, it is in force. Yes, the agent is required to act in your best interests, but it is of the utmost importance that you name someone with the skillset to handle these financial tasks properly, and the integrity to do so in your best interests.

3. A Durable Health Care Power of Attorney (HCPOA)

A health care power of attorney is similar to a financial power of authority, but there are two main differences.

- The power is given to make medical decisions, as opposed to financial decisions.

- The power is only in force when you are incapacitated, not at any other time.

4. Medical Directive

Usually the fourth document, the medical directive, is created to guide the agent in making health care decisions. In your medical directive, you outline the treatment options you want if you are unable to make decisions or communicate those decisions. It’s a way of communicating your decisions in advance and is sometimes called an advance medical directive.

In your health care power of attorney, you designate whether your agent is required to follow your medical directive or simply use it as a guide. The health care power of attorney and the medical directive forms are often combined into one document.

You can see this is serious business with a profound impact on your family. Life is uncertain. If you don’t have these basic documents, contact an experienced legal professional today. Additionally, as life and situations change, you may need to update these documents. A financial adviser can help you make sure these documents and your beneficiary designations match your intentions.