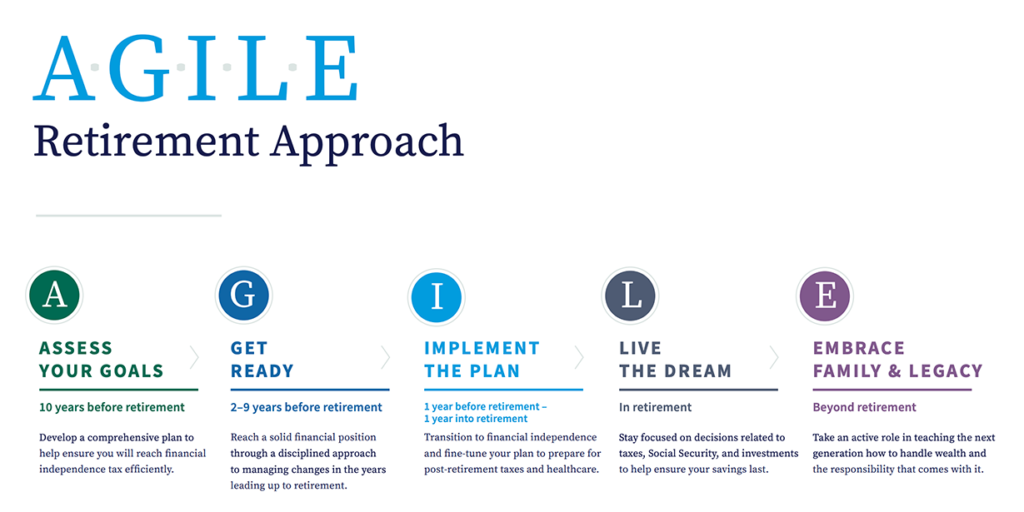

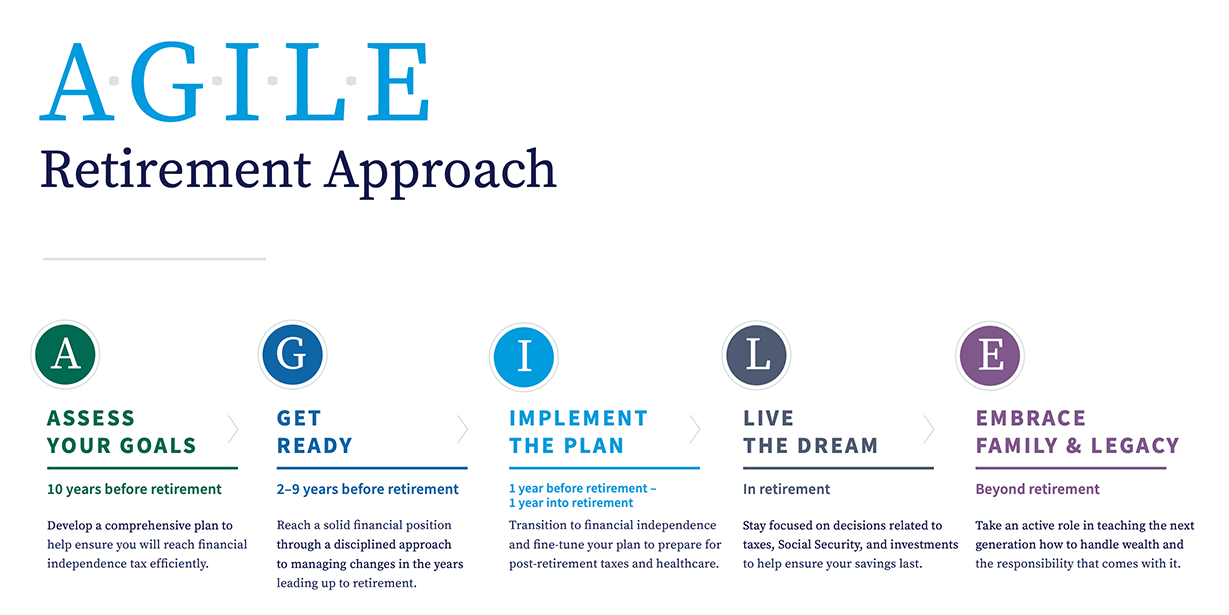

You’ve probably heard it before: retirement is a journey, not a destination. While we agree that retirement isn’t the end; it’s a new beginning, we take a different view of retirement. Our experience has shown that the retirement journey starts well before the last day of work. It is made up of multiple phases which often overlap. These phases include many moments, and most of these moments do not follow a set schedule. Therefore, flexibility is needed when planning for retirement to allow for adjustments. An effective retirement plan is an AGILE one.

From a purely financial standpoint, the fundamental job of a retirement planner is maximizing the probability that clients will not run out of money during retirement. We want our clients to enjoy a long and reasonably worry-free retirement, preferably with money left over for their heirs. However, the retirement journey is not purely financial.

An effective retirement plan should be successful financially and lead to happiness and contentment throughout the journey. This idea that retirement is like a permanent vacation may sound appealing on the surface but may lead to frustration when employment ends.

Envision Your Life in Retirement

We have found that the first phase of the retirement journey, Assess your Goals, is when people should start envisioning a lifestyle that doesn’t require going to work. The keyword being require. Some retirees may be in retirement, but still have a job because they find joy in working. However, they don’t necessarily need to work to get paid. Working could be for a non-profit as a volunteer. This part of the retirement planning process may be better defined as happiness planning.

Work in retirement? Some retirement planners may call this failing retirement. Many people have spent their careers saving for the privilege of not working in retirement. However, we have found that some people who voluntarily continue to work in retirement—even just part-time—are happier than those who don’t work at all. The key again is they aren’t required to work. The effect on the retiree’s happiness can be the opposite if they are forced to work for financial reasons.

Consider Your Physical and Social Health

During the Get Ready phase, we want our clients to think about where they will get physical activity, social interactions, and even a sense of purpose once they leave employment and enter the next phase, Implement the Plan. Employment provides most people with all three of these things during their careers. Finding their replacements can do wonders for new retirees’ physical and mental health, which as we know are important factors in overall happiness and contentment. Relationships are an extremely important part of an enjoyable retirement. Recent studies have shown that married retirees who maintain a good relationship with their spouse are happier and live longer than single retirees. Studies have also suggested that loneliness can result in a higher risk of developing Alzheimer’s and other dementia-related diseases.

We work with clients during the first three phases to get them to think about how they are going to spend their time in retirement so they’re ready to enter Phase 4, Live the Dream. Part of the reason for asking about how retirees plan to spend their time is to help gauge discretionary expenses, i.e., travel costs, hobby expenses, greens fees, etc. But, more importantly, busy retirees tend to be happier. Money magazine reported that the happiest retirees engage in three to four regular activities and the retirees with the busiest schedules tended to be the happiest. The article also suggested for the biggest boost to your happiness, pick a hobby that’s social.

Start Talking About Your Legacy

Phase 5, Establish your Legacy, may be the last phase of retirement, but it should not be the last thing you work on. Wealth can grow relationships, or it can destroy them. Having regular conversations with the next generation provides an opportunity to frame a different set of values and can lead to a different kind of relationship and commitment between parent and child. We encourage clients to have these conversations with their families all through their retirement journey.

For a legacy to flourish, children and grandchildren must be involved, working together to create something and contribute something to the community for the benefit of others. We help our clients reframe the family’s charitable giving as a family project deserving of time and attention proportionate with the effort that went into making the money in the first place. We encourage clients to discuss these issues because every family, regardless of their wealth, should have family meetings.

Make sure you are building an AGILE retirement plan. While financial security is a key ingredient for a successful retirement, be sure not to neglect the other non-financial considerations that make for a happy retirement.

Rick’s Insights:

- The retirement journey is made up of multiple phases which often overlap.

- An effective retirement plan is an AGILE one.

- Retirement plans should be successful financially and lead to happiness and contentment throughout the journey.

1 Spending, Relationship Quality, and Life Satisfaction in Retirement, by Michael S. Finke, The American College. September 23, 2017

2 Feeling Lonely Increases Alzheimer’s Risk, Fisher Center for Alzheimer’s Research Foundation. December 2014.

3 5 Secrets to a Happy Retirement, by Donna Rosato, Money magazine. January 2015.